IR

LOTTE Corp. pledges to uphold transparent management practices

to ensure mutual

growth with its shareholders.

Share Price Information

Corporate Governance

Board of Directors

In tandem with the policy of ‘Transparent Management,’ LOTTE corporation is striving to promote corporate value while maximizing stakeholder profits. The LOTTE corporation Board of Directors currently deliberates on several key details involving those regulated by ordinances and articles of association, those delegated by the general meeting of shareholders and those pertaining to corporate governance fundamental policy and executive operations amid overseeing the operations of the executive staff.

LOTTE corporation Board of Directors is comprised of a total of 9 members: 4 executive & 5 non-executive Directors

Composition of the Board of Directors

Executive Directors

- NameDong-Bin Shin

- Title

Chairman, LOTTE Group

CEO, LOTTE Corporation

CEO, LOTTE WELLFOOD Corporation

CEO, LOTTE Chemical Corporation

CEO, LOTTE Chilsung Beverage Corporation

- Date of

Appointment 2017.10.12 - Present

office term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

Vice Chairman, The Federation of Korean Industries

Vice Chairman, Korea-Japan Economic Association

CGF Board Member

Asia Business Council Member

- NameDong-Woo Lee

- Title

CEO / Vice Chairman,

LOTTE Corporation

The Chairman of

the Board of Directors

- Date of

Appointment 2020.10.08 - Present

office term 2025.03.26 ~ 2027.03.26 (2 years) - Major Career

(Former) CEO, LOTTE Hi-Mart

(Former) CEO, LOTTE World

(Former) Director of Management Support Division,

LOTTE Department Store

- NameJung-Uk Goh

- Title

Head of Financial Innovation Office

/ President, LOTTE Corporation

- Date of

Appointment 2022.03.25 - Present

office term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

(Former) CEO, LOTTE Capital

(Former) Head of Sales 2nd Division

(Former) Head of Business Strategy Division

, LOTTE Chemical

- NameJun-Hyung RHO

- Title

Head of Management Innovation Office / President, LOTTE Corporation

- Date of

Appointment 2024.03.28 - Present

office term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

(Former) CEO, LOTTE INNOVATE

(Former) Head of Strategic Management Division

(Former) Head of DT Business Division

Non-executive Directors

- NamePyung-Oh Kwon

- Title

Non-executive Directors, LOTTE Corporation

- Date of

Appointment 2022.03.25 - Present

Office Term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

(Former) CEO of KOTRA

(Former) Ambassador to Saudi Arabia

(Former) Minister of Trade and Investment,

Ministry of Commerce, Industry and Energy

- NameKyung-Chun Lee

- Title

Non-executive Directors, LOTTE Corporation

- Date of

Appointment 2022.03.25 - Present

Office Term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

(Former) Director of Seoul Bankruptcy Court

(Former) Chief Judge of Seoul High Court

(Former) Director of Judicial Support

, Ministry of Court Administration

- NameHae-Kyoung Kim

- Title

Non-executive Directors, LOTTE Corporation

- Date of

Appointment 2022.03.25 - Present

Office Term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

(Former) CEO, KB Credit Information

(Former) Vice President, KB Credit Information

(Former) Head of KB Bank (Gangdong/north)

- NameNam-Gyoo Park

- Title

Non-executive Directors, LOTTE Corporation

- Date of

Appointment 2022.03.25 - Present

Office Term 2024.03.28 ~ 2026.03.28 (2 years) - Major Career

Professor of Business Administration, Seoul University

(Former) President of the Korean Creativity Society

(Former) Professor of Business Administration, KAIST

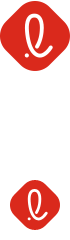

Process of Electing Non-executive Directors

Committee within Board of Directors

| Executive Directors | Non-executive Directors | |

|---|---|---|

| Chairman | Dong-Bin Shin,Dong-Woo Lee | |

| Audit Committee | Hae-Kyoung Kim, Nam-Gyoo Park | |

| Non-executive Director Candidate Nomination Committee | Pyung-Oh Kwon, Nam-Gyoo Park | |

| Transparent Management Committee | Jung-Uk Goh | Kyung-Chun Lee(Chairman), Hae Kyoung Kim |

| Compensation Committee | Jung-Uk Goh | Hae-Kyoung Kim(Chairman), Pyung-Oh Kwon, Kyung-Chun Lee |

| ESG Committee | Jun-Hyung RHO | Nam-Gyoo Park(Chairman), Pyung-Oh Kwon, Kyung-Chun Lee |

| executive committee | Dong-Woo Lee, Jung-Uk Goh, Jun-Hyung RHO |

Articles of Incorporation

- CHAPTER I GENERAL PROVISIONS

Article 1 (Trade Name)

The trade name of this company shall be LOTTE CORPORATION (the “Company”).

Article 2 (Purposes)The purposes of the Company are to engage in the following business activities:

- 1. acquire and hold shares and ownership interests in its subsidiaries (including sub-subsidiaries and other companies controlled by such sub-subsidiaries, hereinafter the “Subsidiaries, Etc.”) and control the businesses of, and guide, organize and improve the management of, the Subsidiaries, Etc.

- 2. evaluate the business performance of the Subsidiaries, Etc. and determination of compensation therefor

- 3. examine business and financial status of the Subsidiaries, Etc.

- 4. provide financial and business support to Subsidiaries, Etc.

- 5. invest in, or securing funding to provide financial support to, Subsidiaries, Etc.

- 6. provide internal control and risk management of the Subsidiaries, Etc.

- 7. engage in joint development and marketing of products and services with Subsidiaries, Etc. and provide business support for joint utilization, etc. of facilities and IT system with Subsidiaries, Etc.

- 8. perform functions entrusted by the Subsidiaries, Etc. to support the business operation of Subsidiaries, Etc., including planning, accounting, legal and IT functions

- 9. provide education and training services to the Subsidiaries, Etc.

- 10. provide or license brands, licenses, etc. to the Subsidiaries, Etc.

- 11. engage in sales and servicing of intangible assets, including knowledge and information, etc. held by the Company

- 12. own real property for business purposes and lease the same to the Subsidiaries, Etc.

- 13. engage in market research, management advisory and consultancy services

- 14. engage in advertisement business and produce and sell advertisement materials within and outside Korea

- 15. develop new technology and engage in R&D

- 16. invest in, manage and operate new technology related business and provide assistance to start-up business; and

- 17. any other businesses incidental to the foregoing.

- (1) The Company’s head office shall be in Seoul.

- (2) If necessary, the Company may establish branches, liaison offices, representative offices or subsidiaries within or outside Korea by a resolution of the Board of Directors.

Public notices of the Company shall be posted on the Company’s Internet website (http://www.lotte.co.kr); provided, however, that if it is impossible to post public notices on the Company’s Internet website due to a technical error or another unavoidable reason, public notices shall be posted in The Korea Economic Daily, a daily newspaper of general circulation in Seoul.

- CHAPTER II SHARES

Article 5 (Number of Total Authorized Shares)

The number of total authorized shares to be issued by the Company shall be 500,000,000 shares.

Article 6 (Par Value per Share)The par value per share to be issued by the Company shall be KRW 200.

Article 7 (Classes of Shares)The classes of the shares to be issued by the Company shall be common shares in a registered form and preferred shares in a registered form.

Article 7-2 (Number and Terms of Class 1 Preferred Shares)- (1) The class 1 preferred shares to be issued by the Company shall be non-voting shares with preferred dividend rights (the “Class 1 Preferred Shares”), and the number of the Class 1 Preferred Shares shall be 750,000 shares.

- (2) The dividends on the Class 1 Preferred Shares shall be not less than nine percent (9%) per annum based on the par value, and the rate thereof shall be determined by the Board of Directors at the time of issuance.

- (3) If the dividend rate declared on common shares exceeds that on the Class 1 Preferred Shares, the shareholders holding the Class 1 Preferred Shares shall be entitled to such excess, which shall be distributed on a pro rata basis to all common shares and Class 1 Preferred Shares.

- (4) If, for any fiscal year, dividends have not been paid on the Class 1 Preferred Shares at the dividend rate prescribed herein, such unpaid dividends shall be paid first on a cumulative basis at the time of payment of dividends for the subsequent fiscal year.

- (5) In the event a resolution has been passed at a meeting of shareholders of the Company that dividends on the Class 1 Preferred Shares shall not be paid as prescribed herein, the shareholders holding the Class 1 Preferred Shares shall be granted voting rights at the meetings of shareholders convened following the aforesaid meeting until and including the meeting of shareholders at which a resolution is passed in favor of payment of the dividends on the Class 1 Preferred Shares.

- (6) If the Company increases its capital by a rights issue or bonus issue, the new shares to be allotted to the Class 1 Preferred Shares shall be common shares in case of a rights issue and shares of the same type in case of a bonus issue.

- (7) The term of the Class 1 Preferred Shares shall be ten (10) years from the date of issuance, and the Class 1 Preferred Shares shall be converted to common shares upon the expiration of such term. However, if the preferred dividends have not been paid by the Company as prescribed herein during the said term, the aforementioned term shall be extended until such unpaid dividends shall have been paid in full. In such case, Article 11 shall apply mutatis mutandis to the payment of dividends on the shares issued upon conversion.

- (1) The class 2 preferred shares to be issued by the Company shall be non-voting shares with preferred dividends (the “Class 2 Preferred Shares”), and the number of the Class 2 Preferred Shares shall not be more than 3,000,000 shares.

- (2) The dividends on the Class 2 Preferred Shares shall be the sum of the dividends paid on common shares and the amount calculated at the rate as determined by the Board of Directors at the time of issuance based on the par value. The rate may be determined, considering all circumstances such as the previous dividend rates, necessity of securing funding and market conditions, etc.

- (3) If no dividend is paid on the common shares, the Company may decide not to pay dividends on the Class 2 Preferred Shares as well.

- (4) In the event the Company is unable to pay the dividends on Class 2 Preferred Shares as prescribed herein from the profits of the relevant fiscal year and a resolution is adopted at a meeting of shareholders not to pay dividends on the Class 2 Preferred Shares, the shareholders holding the Class 2 Preferred Shares shall be granted voting rights at, and until the close of, the meeting of shareholders convened following the aforesaid meeting.

- (5) If the Company increases its capital by a bonus issue and issues class shares with respect to the Class 2 Preferred Shares, the Class 1 Preferred Shares set forth in Article 7-2 shall be allotted thereto.

The share certificates of the Company shall be issued in the following eight (8) denominations: one (1), five (5), ten (10), fifty (50), one hundred (100), five hundred (500), one thousand (1,000) and ten thousand (10,000) shares.

Article 9 (Issuance and Allotment of Shares)- (1) In the event the Company issues new shares by a resolution of the

Board of Directors, it shall be by one of the following methods:

- 1. granting the shareholders an opportunity to subscribe for new shares in order to allot new shares to them in proportion to their respective shareholdings

- 2. granting certain persons (including the shareholders of the Company) an opportunity to subscribe for new shares in order to allot new shares to such persons by a method other than Item 1 above, to the extent that the number of such new shares does not exceed twenty percent (20/100) of the total number of issued and outstanding shares and it is deemed necessary to achieve the Company’s managerial purpose such as acquisition of new technology or improvement of the Company’s financial structure; or

- 3. granting a number of unspecified persons (including the shareholders of the Company) an opportunity to subscribe for new shares by a method other than from Item 1 above, to the extent that the number of such new shares does not exceed fifty percent (50/100) of the total number of issued and outstanding shares and allotting new shares to the persons who subscribed for new shares as above.

- (2) In case of allotting new shares by the method set forth in

Paragraph (1), Item 3 above, new shares shall be allotted by one of the

following methods by a resolution of the Board of Directors:

- 1. allotting new shares to a number of unspecified persons without classifying the types of persons who will be granted an opportunity to subscribe for new shares

- 2. allotting new shares to the members of the Employees Share Ownership Association pursuant to the applicable laws and regulations, and granting a number of unspecified persons an opportunity to subscribe for new shares which are not so subscribed for (if any)

- 3. granting the shareholders a priority opportunity to subscribe for new shares, and then granting a number of unspecified persons an opportunity to subscribe for new shares which are not so subscribed for (if any); or

- 4. granting a certain type of persons an opportunity to subscribe for new shares in accordance with the reasonable standards prescribed by investment traders or investment brokers acting as an underwriter or an intermediary in accordance with the applicable laws and rules, such as demand forecast.

- (3) Notwithstanding Paragraphs (1) and (2) above, if the Company receives from the shareholders of Subsidiaries, Etc. or other companies issued and outstanding shares in such companies as in-kind contribution in order to (i) comply with the requirements or conditions applicable to a holding company under the Monopoly Regulation and Fair Trade Act, (ii) carry out the business of holding shares or ownership interests or (iii) acquire subsidiaries or shares thereof, the Company may allot new shares to the persons holding the shares of such companies (including the shareholders of the Company) by a resolution of the Board of Directors

- (4) In case of allotting new shares by the method set forth in Paragraph (1), Item 2 or 3, the Company shall give a public notice or give notice to the shareholders on the matters prescribed in Article 416, Items 1, 2, 2-2, 3 and 4 of the Korean Commercial Code (the “KCC”) at least two (2) weeks prior to the relevant due payment date; provided, however, that the Company may publish a report on material facts at the Financial Service Commission and the Korea Exchange pursuant to Article 165-9 of the Financial Investment Services and Capital Markets Act (the “FSCMA”) in lieu of such public notice or notice to the shareholders.

- (5) In issuing new shares by a method set forth in Paragraph (1) above, the type, number and the issuance price, etc. of the shares to be issued shall be determined by a resolution of the Board of Directors.

- (6) If there remain shares which have not been subscribed for or paid for until the due date after allotment, the method of dealing with such new shares shall be determined by a resolution of the Board of Directors in accordance with the applicable laws and regulations, including those on the adequacy of the issuance price.

- (7) If there are any fractional shares resulted in the course of allotting new shares, the method of dealing with such fractional shares shall be determined by a resolution of the Board of Directors.

- (8) In issuing new shares pursuant to Paragraph (1), Item 1 above, the Company shall issue to the shareholders the certificate of preemptive right to new shares.

- (1) The Company may grant stock options to its officers and employees (which shall include, for the purpose of this Article, officers and employees of related companies as prescribed in Article 30 of the Enforcement Decree of the KCC) by a special resolution of the General Meeting of Shareholders, to the extent not exceeding fifteen percent (15/100) of the number of total issued and outstanding shares of the Company; provided, however, that the Company may grant stock options to the officers and employees excluding the board members of the Company, by a resolution of the Board of Directors, to the extent not exceeding one percent (1/100) of the number of total issued and outstanding shares. If the Company grants stock options by a resolution of the Board of Directors, the Company shall obtain the approval of the General Meeting of the Shareholders that is convened immediately after granting of such stock options. Stock options granted by a resolution of the General Meeting of Shareholders or the Board of Directors may be linked to the performance of the Company measured by business performance targets or market indices.

- (2) The persons who are entitled to receive such stock options shall be officers and employees who have contributed, or are capable of contributing, to the incorporation, management, overseas sales or technological innovation, etc. of the Company.

- (3) The shares to be delivered upon the exercise of stock options (in the event the Company settles the difference between the exercise price of the stock options and the fair value of the shares to be delivered by cash or treasury shares, the share whose fair value to be appraised) shall be selected among the types of shares set forth in Article 7 hereof, by a resolution of the General Meeting of Shareholders or the Board of Directors granting such stock options.

- (4) The exercise price per share for the stock option shall be equal

to or higher than the amount calculated pursuant to the following

subparagraphs, and the same shall apply when adjusting the exercise price

after the grant of the stock option.

- 1. In case of delivering newly issued shares, the higher of the

following:

A. the fair value of the share of the Company as of the date of granting the stock option; or

B. the par value of the share. - 2. In case of delivering treasury shares of the Company, the fair value of the share of the Company as of the date of granting the stock option.

- 1. In case of delivering newly issued shares, the higher of the

following:

- (5) Stock options granted hereunder may be exercised at least two (2) years after the date of the resolution made pursuant to Paragraph (1) above and within ten (10) years therefrom.

- (6) The grantee of a stock option may exercise the stock option only if he or she shall have served the Company for at least two (2) years from the date of the resolution under Paragraph (1) above; provided, however, that if the said grantee deceases or retires or resigns from the Company due to any reason not attributable to him/her within two (2) years from the date of the resolution under Paragraph (1) above, such stock option may be exercised within the exercise period.

- (7) With regard to the distribution of dividends on shares issued upon the exercise of stock options, the provision of Article 11 hereof shall apply mutatis mutandis.

- (8) In any of the following cases, the Company may revoke the grant

of stock options by a resolution of its Board of Directors:

- 1. if the officer or employee granted the stock option voluntarily retires or resigns;

- 2. if the officer or employee granted the stock option causes material damage to the Company by willful misconduct or negligence;

- 3. if the Company is unable to perform its obligations upon the exercise of stock options due to bankruptcy, dissolution, etc.; or

- 4. if any other event occurs that is stipulated as a ground for revocation in the Stock Option Grant Agreement.

If the Company issues new shares as a result of capital increase with or without payment for the shares or as stock dividend, for the purpose of calculating the accrual of dividends on the new shares, such new shares may be deemed to have been issued at the end of the fiscal year immediately preceding the fiscal year during which such new shares are issued by a resolution of the Board of Directors.

Article 12 (Transfer Agent)- (1) The Company shall designate a transfer agent for shares.

- (2) The transfer agent, its place of business and the scope of its agency work scope shall be determined by a resolution of the Board of Directors, and such facts shall be publicly notified.

- (3) The shareholders registry or duplicates thereof shall be kept at the business place of the transfer agent. The alterations in the registry of shareholders, registration of creation or cancellation of pledges over shares, registration of trust assets or cancellation thereof with respect to shares, issuance of share certificates, receipt of reports and other related matters shall be conducted by the transfer agent.

- (4) The procedures applicable to the tasks provided for in Paragraph (3) above shall be conducted in accordance with the Regulation on Securities Transfer Agency Business of Transfer Agent, Etc.

- (1) Shareholders and registered pledgees shall report their names, addresses, and seals or signatures to the transfer agent set forth in Article 12 above.

- (2) A shareholder or registered pledgee who resides in a foreign country shall report to the Company the appointed agent to receive notices and the addresses in Korea to which notices are to be sent.

- (3) The same shall apply in case of any changes in the matters referred to in Paragraphs (1) and (2) above.

- (1) The Company shall suspend entries of alteration in the shareholders registry from the 1st to the 15st of January of each year.

- (2) The shareholders registered in the shareholders registry as of the last day of each fiscal year shall be entitled to exercise the rights as shareholders at the Ordinary General Meeting of Shareholders convened with respect to such fiscal year.

- (3) The Company may suspend entry of any alterations in the shareholders registry for a period not exceeding three (3) months or set a record date, after giving at least two (2) weeks’ prior public notice thereof, by a resolution of the Board of Directors, if necessary to convene an Extraordinary General Meeting of Shareholders or otherwise; provided, however, that the Board of Directors may decide the suspension of entry of any alterations in the shareholders registry and a record date at the same time, if deemed necessary.

- CHAPTER III BONDS

Article 15 (Issuance of Bonds)

- (1) The Company may issue bonds by a resolution of the Board of Directors.

- (2) The Board of Directors may delegate to the Representative Director the issuance of bonds by determining the amount and types of the bonds to be issued within a period not exceeding one (1) year.

- (1) The Company may, in any of the following cases, issue convertible

bonds to persons other than the existing shareholders of the Company by a

resolution of the Board of Directors to the extent that the aggregate sum of

the face value of such convertible bonds so issued shall not exceed KRW 2

trillion:

- 1. issuance by way of granting certain persons (including the shareholders of the Company) an opportunity to subscribe for the bonds to allot bonds to such persons by a method other than Article 9, Paragraph (1), Item 1 above, if it is necessary to achieve the Company’s business purpose such as acquisition of new technology or improvement of the Company’s financial structure;

- 2. issuance by way of granting a number of unspecified persons (including the shareholders of the Company) an opportunity to subscribe for the bonds by a method other than Article 9, Paragraph (1), Item 1 above and allotting the bonds to the persons who subscribed for the bonds;

- 3. overseas issuance pursuant to Article 165-16 of the FSCMA;

- 4. issuance to domestic or foreign financial institutions for the purpose of emergency financing; or

- 5. issuance for the purpose of inducing foreign investment.

- (2) In case of allocating bonds by the method prescribed in Paragraph

(1), Item 2 above, the bonds shall be allotted by any one (1) of the

following methods by a resolution of the Board of Directors:

- by allotting the bonds to a number of unspecified persons without classifying the types of persons who are granted an opportunity to subscribe for the bonds;

- 2. by granting shareholders a priority opportunity to subscribe for the bonds, and then granting a number of unspecified persons an opportunity to be allotted the bonds that not so subscribed for (if any); or

- 3. granting a certain type of persons an opportunity to subscribe for the bonds accordance with reasonable standards prescribed by investment traders or investment brokers acting as an underwriter or an intermediary in accordance with the applicable laws and rules, such as demand forecast.

- (3) The convertible bonds issued pursuant to Paragraph (1) above may be issued with a condition that only a portion may be converted by a resolution of the Board of Directors.

- (4) The shares to be issued upon conversion shall be common shares, Class 1 Preferred Shares or Class 2 Preferred Shares, and the conversion price, which shall be equal to or higher than the par value per share of such shares, shall be determined by the Board of Directors at the time of issuance of such bonds.

- (5) The period during which conversion right may be exercised shall commence on the date following one (1) month from the issuance date of the relevant convertible bonds and end on the date immediately preceding the redemption date thereof; provided, however, that the conversion period may be adjusted within the foregoing period by a resolution of the Board of Directors.

- (6) With regard to the distribution of dividends on the shares issued upon conversion and the payment of accrued interests on the convertible bonds, the provision of Article 11 hereof shall apply mutatis mutandis.

- (1) The Company may, in any of the following cases, issue bonds with

warrants to persons other than the existing shareholders of the Company to

the extent that the aggregate sum of the face value of such bonds with

warrants so issued shall not exceed KRW 2 trillion:

- issuance by way of granting certain persons (including the shareholders of the Company) an opportunity to subscribe for the bonds to allot the bonds to such persons by a method other than Article 9, Paragraph (1), Item 1 above, if it is necessary to achieve the Company’s business purpose, such as acquisition of new technology or improvement of the Company’s financial structure;

- 2. issuance by way of granting a number of unspecified persons (including the shareholders of the Company) an opportunity to subscribe for of the bonds by a method other than Article 9, Paragraph (1), Item 1 above, and allotting the bonds to persons who subscribed for such bonds;

- 3. overseas issuance pursuant to Article 165-16 of the FSCMA;

- 4. issuance to domestic or foreign financial institutions for the purpose of emergency financing; or

- 5. issuance for the purpose of inducing foreign investment.

- (2) In case of allotting the bonds by the method prescribed in

Paragraph (1), Item 2 above, the bonds shall be allotted by any one (1) of

the following methods by a resolution of the Board of Directors:

- by allotting the bonds to a number of unspecified persons without classifying the types of persons who are granted an opportunity to subscribe for the bonds;

- 2. by granting shareholders a priority opportunity to subscribe for the bonds, and then granting a number of unspecified persons an opportunity to be allotted the bonds that are not so subscribed for (if any); or

- 3. granting a certain type of persons an opportunity to subscribe for the bonds accordance with reasonable standards prescribed by investment traders or investment brokers acting as an underwriter or an intermediary in accordance with the applicable laws and rules, such as demand forecast

- (3) The exercise price of the warrants shall be determined by the Board of Directors to the extent that the aggregate amount of such exercise price shall not exceed the total face value of the bonds with warrants.

- (4) The shares to be issued upon exercise of the warrants shall be common shares, Class 1 Preferred Shares or Class 2 Preferred Shares. The issuance price, which shall be equal to or higher than the par value per share of such new shares, shall be determined by the Board of Directors at the time of issuance of such bonds.

- (5) The period during which the warrants may be exercised shall commence on the date following one (1) month from the issuance date of the relevant bonds with warrants and end on the date immediately preceding the redemption date thereof; provided, however, that the exercise period may be adjusted within the foregoing period by a resolution of the Board of Directors.

- (6) With regard to the distribution of dividends on the shares issued as a result of exercise of warrant, the provision of Article 11 hereof shall apply mutatis mutandis.

The provisions of Articles 12 and 13 shall apply mutatis mutandis to the issuance of bonds.

- CHAPTER IV GENERAL MEETINGS OF

SHAREHOLDERS

Article 19 (Convening of General Meetings of Shareholders)

- (1) The General Meetings of Shareholders of the Company shall be either ordinary or extraordinary.

- (2) The Ordinary General Meeting of Shareholders shall be held within three (3) months after the end of each fiscal year, and the Extraordinary General Meeting of Shareholders may be convened whenever necessary.

- (1) Except as otherwise provided in the applicable laws and regulations, the Representative Director shall convene a General Meeting of Shareholders in accordance with a resolution of the Board of Directors.

- (2) If the Representative Director is absent and/or unable to perform his/her duties, the provision of Article 36, Paragraph (2) shall apply mutatis mutandis.

- (1) In convening a General Meeting of Shareholders, the Company shall give notice in writing or by electronic document to each shareholder, stating the date, time and place of the meeting and the agenda to be dealt with at the meeting at least two (2) weeks prior to the date set for such meeting.

- (2) The convocation notice to shareholders holding not more than one percent (1/100) of the number of the total issued and outstanding shares entitled to vote may be substituted by either (i) providing a public notice of the convening of the General Meeting of Shareholders together with the agenda of the meeting in The Korea Economic Daily and Maeil Economic Daily published in Seoul two (2) weeks prior to the date set for such meeting, each by two (2) times or more or (ii) providing a public notice in the Data Analysis Retrieval and Transfer (“DART”) system operated by the Financial Supervisory Service or Korea Exchange.

The General Meeting of Shareholders shall be held at the place where the head office is located or any other places adjacent thereto as necessary.

Article 23 (Chairman of the General Meeting of Shareholders)- (1) The Chairman of the General Meeting of Shareholders shall be the Representative Director; provided, however, that if there are more than one (1) Representative Directors, the Chairman shall be determined by a resolution of the Board of Directors.

- (2) In the event the Representative Director is absent or unable to perform his/her duties, the provision of Article 36, Paragraph (2) shall apply mutatis mutandis.

- (1) The Chairman of the General Meeting of Shareholders may order who notably disturbs the order by intentionally speaking or acting for a filibuster, to stop speaking or to leave the meeting room.

- (2) The Chairman of the General Meeting of Shareholders may restrict the duration and/or the number of speeches made by each shareholder whenever the Chairman deems it necessary for smooth proceedings of the General Meeting of Shareholders.

Each shareholder shall have one (1) vote for each share.

Article 26 (Limitation on Voting Rights of Cross-Held Shares)In the event the Company, its subsidiary or the Company and its subsidiary together hold shares that are in excess of one-tenth (1/10) of the number of the total issued and outstanding shares of another company, the shares of the Company held by such other company shall not have voting rights.

Article 27 (Exercise of Voting Rights in Disunity)- (1) If any shareholder who holds two (2) or more votes wishes to exercise his/her votes in disunity, he/she shall give written notice to the Company of such intent and the reasons therefor no later than three (3) days before the date set for the General Meeting of Shareholders.

- (2) The Company may refuse to allow such shareholder to exercise his/her votes in disunity unless he/she has acquired the shares in trust or otherwise holds the shares for and on behalf of another person.

- (1) A shareholder may exercise his/her voting rights by proxy.

- (2) In the case of Paragraph (1) above, the proxy holder shall file with the Company the documents evidencing his/her power of representation (power of attorney) before the commencement of the General Meeting of Shareholders.

Except as otherwise provided in the applicable laws and regulations, all resolutions of the General Meeting of Shareholders shall be adopted by the affirmative vote of a majority of the shareholders present; provided, however, that such affirmative votes shall, in any event, represent not less than one-fourth (1/4) of the number of the total issued and outstanding shares.

Article 30 (Minutes of the General Meetings of Shareholders)The course of proceedings of the General Meeting of Shareholders and the results thereof shall be recorded in minutes, which shall be either affixed with the names and seals of or signed by the Chairman and the directors present at the meeting and be kept at the principal office and branches of the Company.

- CHAPTER V DIRECTORS, BOARD OF

DIRECTORS AND COMMITTEES

Article 31 (The Number of Directors)

- (1) The Company shall have at least three (3) but not more than nine (9) directors.

- (2) The Company shall have at least three (3) outside directors, which shall be a majority of the total number of directors.

- (1) The directors shall be elected at the General Meeting of Shareholders; provided, however, that the outside directors shall be appointed among those recommended by the Outside Director Candidate Recommendation Committee.

- (2) The directors shall be elected by the affirmative vote of a majority of the voting shares presented at the General Meeting of Shareholders, which shall be at least one-fourth (1/4) of the number of the total issued and outstanding shares of the Company.

- (3) In the event the Company elects two (2) or more directors, the cumulative voting system stipulated in Article 382-2 of the KCC shall not apply.

The term of office of directors shall be determined by the General Meeting of Shareholders up to three (3) years; provided, however, that if such term of office expires prior to the Ordinary General Meeting of Shareholders that is convened in respect of the immediately preceding fiscal year, such term of office shall be extended until the close of such meeting.

Article 34 (By-election of Directors)Any vacancy in the office of directors shall be filled at the General Meeting of Shareholders; provided, however, that the foregoing provision shall not apply if the number of remaining directors satisfies the requirement set forth in Article 31 and such vacancy does not cause any difficulties in performance of duties.

Article 35 (Election of Representative Director, Etc.)The Company may appoint the Representative Director among the directors of the Company by a resolution of the Board of Directors.

Article 36 (Duties of Directors)- (1) The Representative Director shall represent the Company and shall oversee the business of the Company.

- (2) The Vice-President, executive directors (Jeonmu), managing directors (Sangmu) and directors shall assist the Representative Director and divide and perform the Company’s businesses as may be determined by the Board of Directors. In the event the Representative Director is absent or unable to perform his/her duties, the persons set forth above shall perform the Representative Director’s duties in the order written above.

Upon discovery of anything that could cause significant damage to the Company, such director shall promptly report it to the Audit Committee.

Article 38 (Composition and Convening of the Meeting of Board of Directors)- (1) The Board of Directors shall consist of directors and make decisions on material matters concerning the Company.

- (2) A meeting of the Board of Directors shall be convened by the Representative Director or, if another director is designated by the Board of Directors, such designated director, by notifying each director at least three (3) days prior to the date of such meeting. Such notice, however, may be omitted upon unanimous consent by all the directors.

- (3) The Chairman of the Board of Directors shall be the person authorized to convene the meetings of the Board of Directors under the provision of Paragraph (2) above.

- (1) The Company may establish the following committees within the

Board of Directors by a resolution of the Board of Directors:

- Executive Committee;

- 2. Audit Committee;

- 3. Outside Director Candidate Recommendation Committee;

- 4. Transparent Management Committee; and

- 5. other committees as the Board of Directors may deem necessary.

- (2) Unless otherwise provided in the applicable laws and regulations, the details concerning the establishment, operation, etc. of each committee shall be determined by a resolution of the Board of Directors.

- (3) Provisions of Articles 40 through 42 shall apply mutatis mutandis to the committees.

- (1) The Company may establish the Executive Committee, which consists of standing directors and executive officers, separately from the Board of Directors, for expeditious and smooth business decision-making.

- (2) The Executive Committee shall deliberate and decide on the matters delegated by the Board of Directors among the Company’s material business matters.

- (1) The Company may establish the Audit Committee by a resolution of the Board of Directors pursuant to Article 39, Paragraph (1) hereof.

- (2) The Audit Committee shall consist of not less than three (3) directors (with at least two-thirds (2/3) of the members to be outside directors), and the qualification and the methods of appointment of any member of the Audit Committee shall comply with the requirements prescribed by the applicable laws and applications including the KCC.

- (3) The Audit Committee shall appoint its representative among the outside directors by a resolution of the Audit Committee.

- (4) Details regarding the composition, operation, etc. of the Audit Committee shall be determined by the Board of Directors.

- (1) The Company may establish the Outside Director Candidate Recommendation Committee by a resolution of the Board of Directors pursuant to Article 39, Paragraph (1) hereof.

- (2) Details regarding the composition, operation, etc. of the Outside Director Candidate Recommendation Committee shall be determined by the Board of Directors.

Decision on the matters requiring a resolution of the Board of Directors may be delegated to the Representative Director or a committee, except for those required by the laws and regulations or these Articles of Incorporation.

Article 41 (Method of Resolution of the Board of Directors)- (1) The resolutions of the Board of Directors shall be adopted in the presence of a majority of the directors and by the affirmative vote of a majority of the directors present; provided, however, that the resolutions of the Board of Directors regarding the matters set forth in Article 397-2 (Prohibition against Appropriation of Company’s Opportunities and Assets) and Article 398 (Prohibition against Self-Transaction) of the KCC shall be adopted by the affirmative vote of at least two-thirds (2/3) of the directors in office.

- (2) The Board of Directors may permit all or some of its directors to participate in the meeting by means of communication simultaneously transmitting and receiving live audio communications, in lieu of attending such meeting in person. In such case, directors participating in the meeting in the aforementioned manner shall be deemed to be present in person at such meeting.

- (3) Any director who has a special interest in a matter to be resolved by the Board of Directors shall not exercise his or her voting right.

- (1) The proceedings of a meeting of the Board of Directors shall be recorded in minutes.

- (2) The agenda, proceedings, results, dissenting director (if any) and his/her reasons for dissenting shall be recorded in minutes. The names and seals of the directors present at the meeting shall be affixed thereon, or the minutes shall be signed by them.

- (1) The amount of remuneration for the directors shall be determined by a resolution of the General Meeting of Shareholders.

- (2) Severance payments for the directors shall be made in accordance with the provisions of the Regulations on Severance Payments for Officers adopted by a resolution of the General Meeting of Shareholders

- CHAPTER VI ACCOUNTING

Article 44 (Fiscal Year)

The fiscal year of the Company shall begin on January 1 and end on December 31 of each year.

Article 45 (Preparation and Maintenance of Financial Statements and Business Reports)- (1) The Representative Director of the Company shall prepare and have

audited by the Audit Committee the following documents and supplementary

schedules thereto and business report six (6) weeks before the date set for

the Ordinary General Meeting of Shareholders and then submit the following

documents and business report to the Ordinary General Meeting of

Shareholders:

- balance sheet;

- income statements; and

- other documents prescribed by the Enforcement Decree of the KCC, indicating the financial status and business performance of the Company.

- (2) In the event the Company falls under the category of a company which is required to prepare consolidated financial statements prescribed by the Enforcement Decree of the KCC, consolidated financial statements shall be included in the documents referred to in Paragraph (1) above.

- (3) The Audit Committee shall submit an audit report to the Representative Director no later than one (1) week before the date of the Ordinary General Meeting of Shareholders.

The Company shall dispose of the unappropriated retained earnings of each fiscal year as follows:

- 1.earned surplus reserves (earned surplus reserves under the KCC);

- 2.other statutory reserves;

- 3.dividends;

- 4.discretionary reserves;

- 5.other disposition of earned surplus; and

- 6.retained earnings carried over to the subsequent year.

- (1) Dividends may be distributed in cash, stock or other assets.

- (2) In case the Company distributes dividends by issuing new shares and has issued different classes of shares, dividends may be paid in different classes of shares by a resolution of the General Meeting of Shareholders.

- (3) Dividends in Paragraph (1) above shall be paid to the shareholders or pledgees of the shares of the Company registered in the Company’s shareholders registry as of the last day of each fiscal year.

- (1) The Company may distribute interim dividends pursuant to Article 462-3 of the KCC to the shareholders registered in the shareholders registry as of 00:00 a.m., July 1.

- (2) The interim dividends under Paragraph (1) shall be paid by a resolution of the Board of Directors, which shall be made within 45 days from the record date set forth in Paragraph (1) above.

- (3) The interim dividends shall not exceed the amount calculated by

deducting the following amounts from the value of the net assets on the

balance sheet of the immediately preceding fiscal period:

- 1. the amount of capital of the immediately preceding fiscal period;

- 2. the total amount of capital reserves and earned surplus reserves accumulated until the immediately preceding fiscal period;

- 3. the unrealized gains set forth in the Enforcement Decree of the KCC;

- 4. the amount determined to be distributed as dividends at the General Meeting of Shareholders with respect to the immediately preceding fiscal period;

- 5. the discretionary reserve accumulated for a specific purpose pursuant to the provisions of these Articles of Incorporation or a resolution of the General Meeting of Shareholders until the immediately preceding fiscal period; and

- 6. the amount of earned surplus reserves to be accumulated with respect to the applicable fiscal period due to the interim dividends.

- (4) If any new shares have been issued prior to the record date specified in Paragraph (1) above following the commencement date of the fiscal year (including as a result of capitalization of reserves, stock dividends, conversion of convertible bonds and the exercise of warrants with respect to the bonds with warrant), such new shares shall be deemed to have been issued at the end of the immediately preceding fiscal year for the purpose of interim dividends.

- (1) The right to claim payment of dividends shall be extinguished if not exercised within five (5) years.

- (2) The dividends, for which the right has been extinguished pursuant to Paragraph (1) above, shall be vested in the Company.

- (1) The Representative Director of the Company shall prepare and have

audited by the Audit Committee the following documents and supplementary

schedules thereto and business report six (6) weeks before the date set for

the Ordinary General Meeting of Shareholders and then submit the following

documents and business report to the Ordinary General Meeting of

Shareholders:

- ADDENDUM

Article 1 (Effective Date)

These Articles of Incorporation shall become effective when the spin-off and split-merger takes effect pursuant to the Spin-off Plan dated April 26, 2017 and the Split-Merger Agreement by and among the Company, Lotte Shopping Co., Ltd., Lotte Chilsung Beverage Co., Ltd. and Lotte Foods Co., Ltd.

Article 2 (Appointment of Directors, Representative Director and Audit Committee Members, Etc. in the Course of Split-Merger)Notwithstanding Article 32, Paragraph (1) and Article 35, Paragraph (1) of these Articles of Incorporation, the directors (including outside directors), Representative Director and Audit Committee members included in the Split-Merger Agreement entered into by and among the Company, Lotte Shopping Co., Ltd., Lotte Chilsung Beverage Co., Ltd. and Lotte Foods Co., Ltd., through the approval of the General Meeting of Shareholders pursuant thereto, shall be appointed as the directors (including outside directors), Representative Director and Audit Committee members of the Company without any separate procedures such as approval of the Board of Directors or the General Meeting of Shareholders or recommendation of the Outside Director Candidate Recommendation Committee, and their terms of office shall commence on the effective date of the split-merger.

Shareholder Policy

Dividends

(KRW)

| Year | FY 2024 | FY 2023 | FY 2022 | FY 2021 | FY 2020 | |

|---|---|---|---|---|---|---|

| Dividend type | Cash | Cash | Cash | Cash | Cash | |

| Dividends per Share | Common Stock | 1,200 | 1,500 | 1,500 | 1,500 | 1,000 |

| Preferred Stock | 1,250 | 1,550 | 1,550 | 1,550 | 1,050 | |

| Total Amount of Dividends | Common Stock | 85 bn | 106.2 bn | 106.2 bn | 106.2 bn | 70.8 bn |

| Preferred Stock | 0.9 bn | 1.1 bn | 1.1 bn | 1.1 bn | 0.7 bn | |

| Subtotal | 85.9 bn | 107.3 bn | 107.3 bn | 107.3 bn | 71.5 bn | |

| Net profit (separate) | -440.9 bn | -57.8 bn | 63.7 bn | -36.4 bn | -307.1 bn | |

| Dividend Payout Ratio | - | - | 167% | - | - | |

| Dividend Yield | Common Stock | 5.8% | 5.3% | 4.6% | 4.9% | 2.9% |

| Preferred Stock | 5.1% | 4.2% | 3.6% | 3.3% | 1.6% | |

※ Dividend yield: Disclosure standard (the ratio of dividends per share to the

arithmetic average price of the closing price of the stock market over the past

week prior to the trading date of the two-member register of shareholders).

※ October 2017, Lotte Holdings Co., Ltd. was newly established.

Treasury Share Cancellation

| Date | Quantity of Treasury shares Cancellation | Shares Outstanding | |

|---|---|---|---|

| Before Cancellation | After Cancellation | ||

| `19.01.14 | 11,657,000 shares (10% of total outstanding shares) |

116,566,237 shares | 104,909,237shares |

Analyst Coverage

| Company Name | Analyst |

|---|---|

| NH Investment & Securities | Kim, Dong Yang |

| Daishin Securities | Yang, Ji Hwan |

| Yuanta Securities Korea | Choi, Nam Gon |

Announcement

| NO | Performance data | Attachments | Date |

|---|---|---|---|

| 10 | 2017년 3분기 연간실적 2017년 3분기 연간실적 2017년 3분기 연간실적 2017년 3분기 연간실적 2017년 3분기 연간실적 | download | 2017.10.16 |

| 9 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 8 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 7 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 6 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 5 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 4 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 3 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 2 | 2017년 3분기 연간실적 | download | 2017.10.16 |

| 1 | 2017년 3분기 연간실적 | 첨부파일 없음 | 2017.10.16 |